コレクション in absence of partnership deed partners are entitled to what percent of profit as salary 487695-In absence of partnership deed partners are entitled to what percent of profit as salary

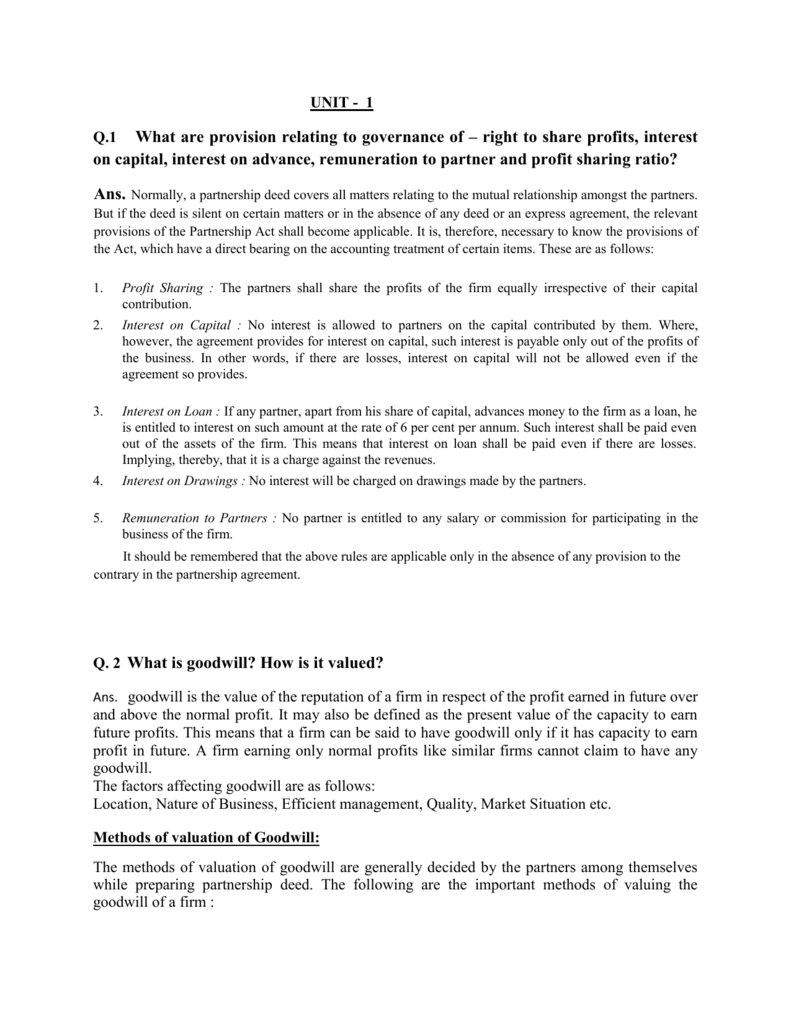

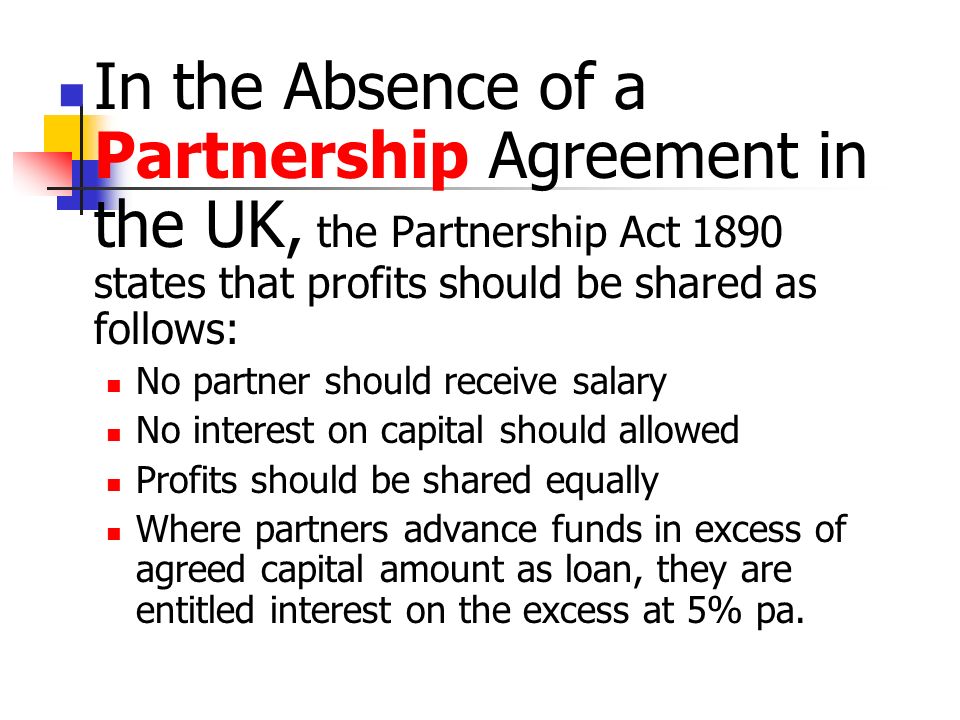

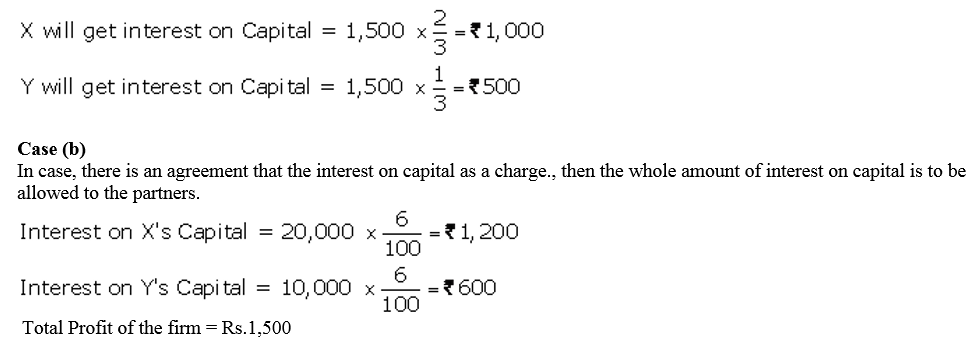

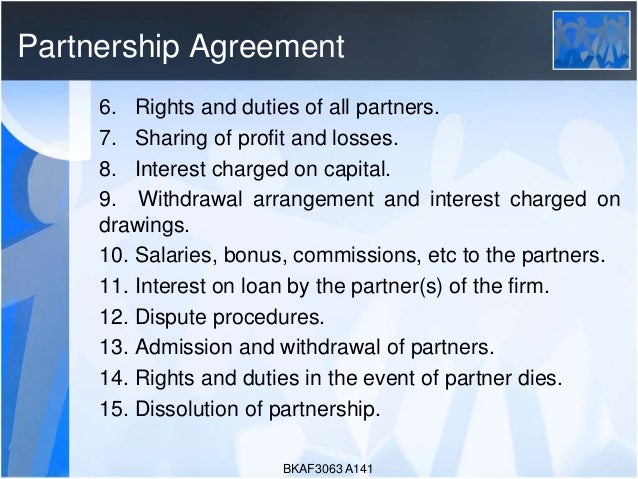

If there is no mention regarding this, in the partnership agreement (deed), then no interest need be paid Only out of profits Interest is to be paid only out of profits Where there is a loss, no interest should be paid on capital, even if the partnership agreement provides for the same @ 6% if rate is not mentionedJune 11) (A) @ 5% pa (B) @ 6% pa @ 12% pa (D) No interest is allowed Answer 19That all the WORKING PARTNERS may be paid Salary wef 1 St day of March of , for the work of the FIRM as may be agreed mutually from time to time between the PARTIES in accordance with the provisions of the Income Tax Laws as well as business necessities and other factors, subject however, that the monthly Salary to each such Partner shall not exceed as under That

Samacheer Kalvi 12th Accountancy Guide Chapter 3 Accounts Of Partnership Firms Fundamentals Samacheer Kalvi

In absence of partnership deed partners are entitled to what percent of profit as salary

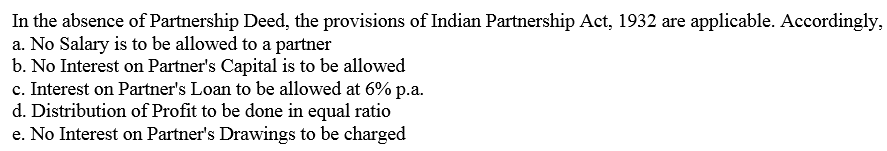

In absence of partnership deed partners are entitled to what percent of profit as salary- In the absence or of any Partnership Agreement, the profits or losses of the firm are divided (A) In Capital Ratio (B) In Equal Ratio In any of these two ratios (D) None of these Answer In Equal Ratio 4 In the absence of partnership deed, the partner will be allowed interest on the amount advanced to the firm by him at the rate of (A) 6%(i) Sharing of profits and losses If the partnership deed is silent on sharing of profit or losses among the partners of a firm, then according to the Partnership Act of 1932, profits and losses are to be shared equally by all the partners of the firm (ii) Interest on partner's capital If the partnership deed is silent on interest on partner's capital, then according to the Partnership

2 Accountancy Chapter 2 Accounting For Partnership Basic Concepts

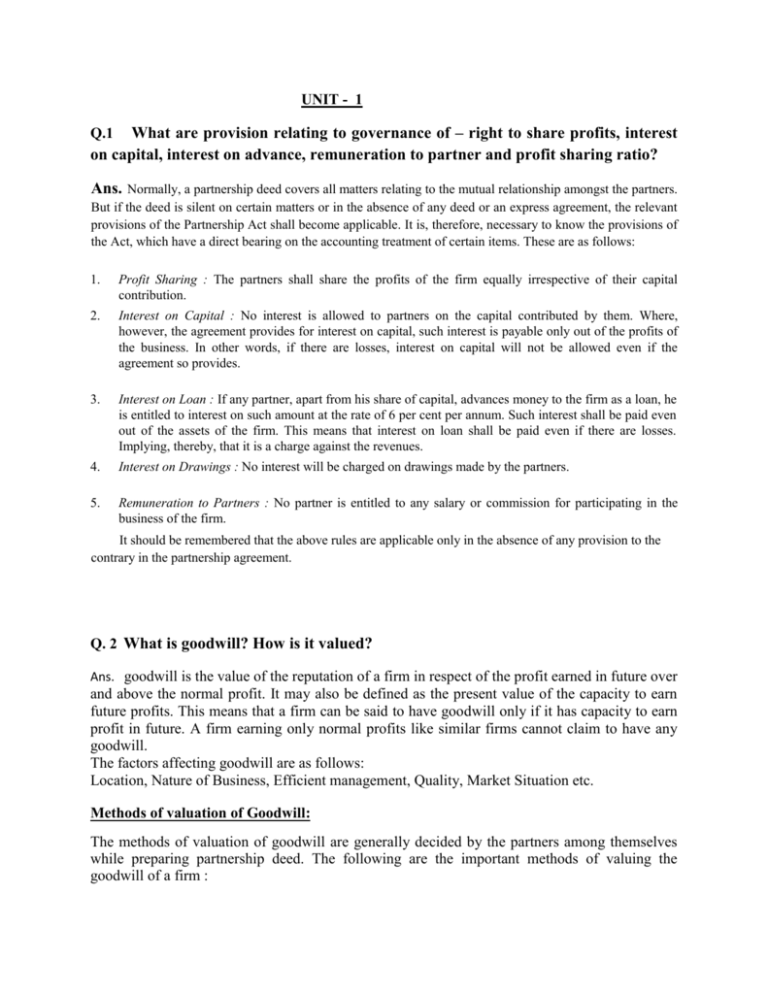

The deductions regarding salary to partners and any payment of interest to partners cannot exceed the monetary limits specified u/s 40(b) and are available subject to the fulfillment of conditions mentioned therein The following conditions must be satisfied before claiming any deduction in respect of salary, bonus, commission or other remuneration payable to partner by a partnershipShare It On Facebook Twitter Email 1 Answer 1 vote answered by RupaRani (663k points) selected by Umesh01 Best answer (d) All of the But if the deed is silent on certain matters or in the absence of any deed, the relevant provisions of the Partnership Act shall become applicable It is, therefore, necessary to know the provisions of the Act, which have a direct bearing on the accounting treatment of certain items These are as follows Profit Sharing The partners shall share the profits of the firm equally

(D) when the partner's salary and interest on capital are not incorporated in the partnership deed Answer 18 In the absence of Partnership Deed, the interest is allowed on partner's capital (CPT;The facts are the same as in example 1 but Alan is entitled to a salary of £4,400, and profits/losses are shared Alan 25%, Beatrice 25% and Cassandra 50% This time the partnershipInterest on Capital – Not Allowed;

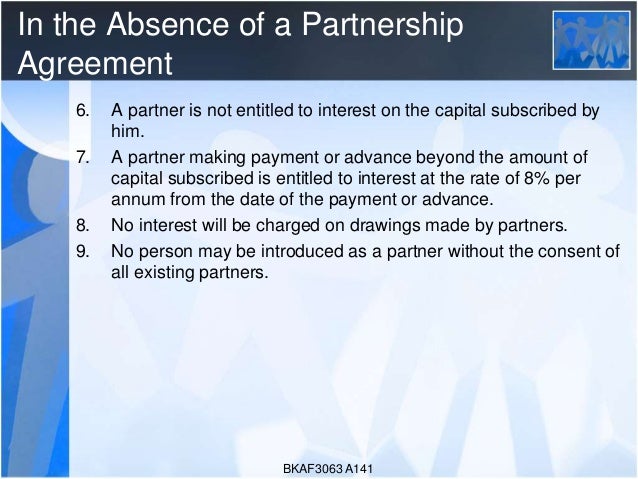

Partners are not entitled to receive in the absence of partnership agreement (a) salaries (b) interest on capital (c) fees and commission (d) All of the above general introduction of partnership;In the absence of a partnership deed, the following rules have to be followed 1 The partners are entitled to share the profits or losses equally 2 Partners are not entitled to interest on their capital 3 No partner will be allowed salary, or any other remuneration for any extra work done for the firm ADVERTISEMENTS 4 No interest will be charged on partners' drawings 5 Interest at In the absence of partnership deed partners are entitled to receive _____ (a) Interest on Capital (b) Interest on Loan (c) Salary (d) Commission Answer Answer (b) Interest on Loan Question 19 When question is silent about the date of withdrawal of drawing then Interest will becalculated for _____ (a) 6 months (b) 1 month (c) 6½ months (d) 1 year Answer Answer (a) 6

2

Tax Rules For Partnership Interest Changes Bader Martin

In the absence of partnership deed, profits are divided by partners in the ratio of a capital b time devoted c equal d none of these Answers 3 Get Other questions on the subject Accountancy Accountancy, 0400, piyush Where we take on salary and wages in profit and loss and balance sheet and manufacture account Answers 1 continue In the absence of Partnership Deed, the interest is allowed on the loan given by partners to the firm(a) 9% p a (b) 8 % pa (c) 6% pa (d) 5 % pa 31 According to Profit and Loss A/c, the net profit for the year is ₹ 29,977 The total interest on the partners' capitals is ₹ 3,250 and the interest on the drawing of the partner is ₹ 900 The net profit according to Profit 3 Salary/ Commission to partner No partner is entitled to salary/ commission from the firm, unless the partnership deed provides for it 4 Interest on loan If any partner, apart from his share capital, advances money to the firm as loan, he is entitled to interest on such amount at the rate of six percent per annum 5 Profit sharing ratio The partners shall share the profits of

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 21

All About Indian Partnership Act 1932 By Lakhan Gupta

In the absence of a specific agreement, interest on capital is paid only out of profit 11 A partner acts as an agent for a firm 12 Partners are mutual Agents for each other 13 In absence of Partnership agreement interest on partner's loan/Advance will be calculated at Q11 When is the Partnership Act enforced (i) when there is no partnership deed (ii) where there is a partnership deed but there are differences of opinion between the partners (iii) when capital contribution by the partners varies (iv) when the partner's salary and interest on capital are not incorporated in the partnership deed In case if partner does not make agreement or deed, then partners are entitled for interest on loans and advances and their profit sharing ratio will be equal They are not entitled for salary and commission hope it will help you plz mark me as brainliest and thanks for my answer and follow me Advertisement Advertisement

Partnership Deed Its Importance And Rights Of Partners Accounting Finance

Samacheer Kalvi 12th Accountancy Guide Chapter 3 Accounts Of Partnership Firms Fundamentals Samacheer Kalvi

Partnership has three partners , as per PA one has salary of £30k, thereafter profits are split equally Profit before salary but after £21k depreciation is £90k is the following correct accounts salaried partner profit (£30k plus £k) other partners have £k each tax taxable profit is £111k(£90k plus £21k depn) how is thisIn the absence of partnership deed A Partners are entitled for any remuneration B Interest is to be charged on drawing C Partners share profit or losses equally D Partners are entitled to any interest on their capital balances Answer Correct option is C Partners share profit or losses equally 1 # All partners will divide profit and loss equally 2 # If any partner gave loan to In the absence of a partnership deed, specify the rules relating to the following (i) Sharing of profits and losses (ii) Interest on partner's capital (iii) Interest on partner's drawings (iv) Interest on partner's loan (v) Salary to a partner

2

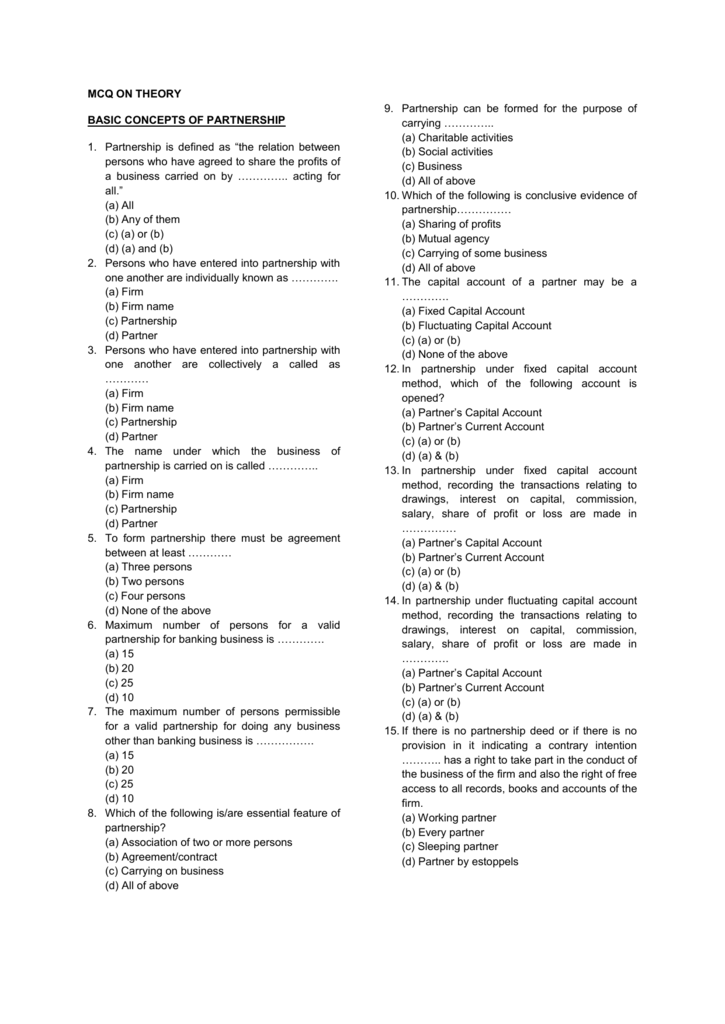

Mcq On Basics Of Partnership Multiple Choice Questions And Answers Partnership Accounts Mcqs Cma Mcq

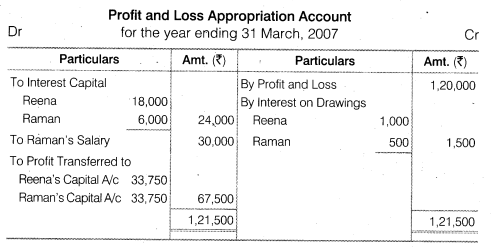

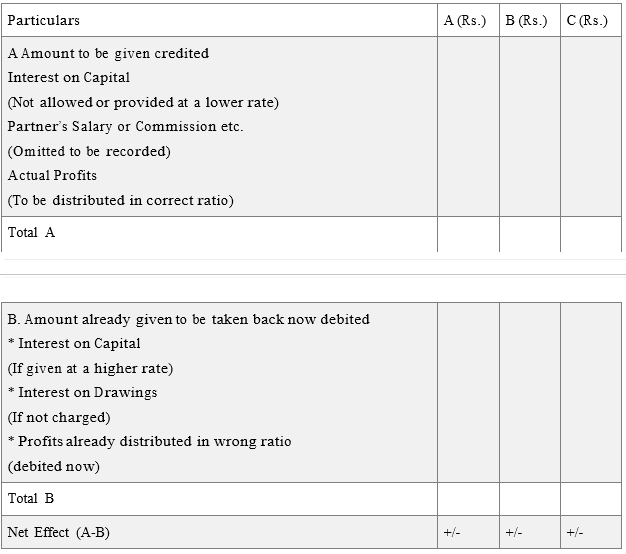

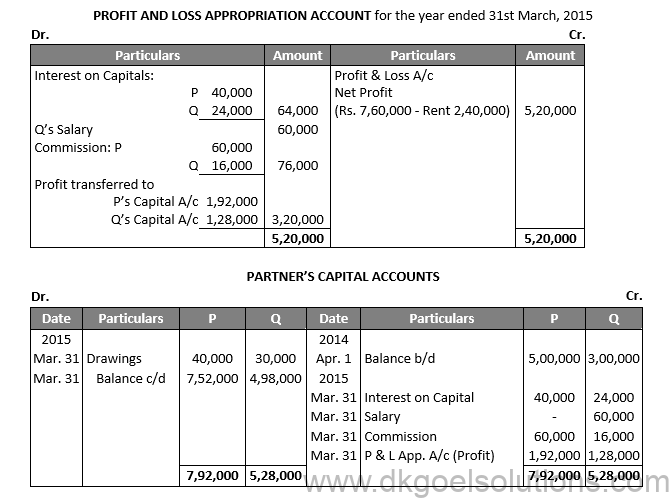

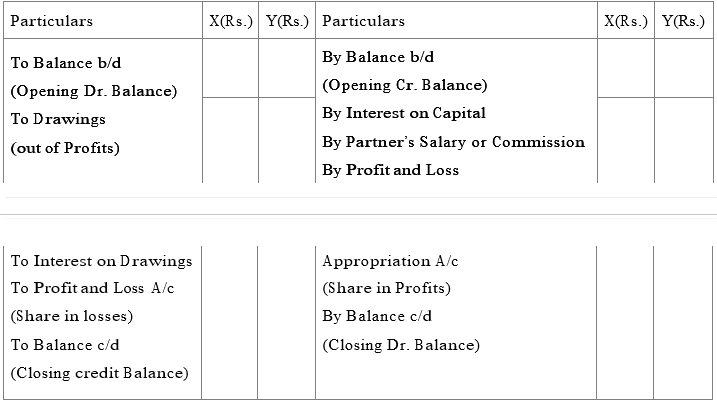

In the absence of partnership deed, the following rule will apply (A) No interest on capital (B) Profit sharing in capital ratio Profit based salary to working partner (D) 9% pa interest on drawings Ans (A) No interest on capital MCQ Questions Answers for Class 12 Accountancy 4 Partners in the agreement are not entitled to (A) Salary (B) CommissionsIn a partnership firm, partner A is entitled a monthly salary of Rs7,500 At the end of the year, firm earned a profit of Rs75,000 after charging A's salary If the manager is entitled a commission of 10% on the net profit after charging his commission, Manager's commission will be (A) Rs7,500 (B) Rs 16,500 Rs8,250 (D) Rs 15,000A Profit and Loss Appropriation Account is prepared to show the distribution of profits among partners as per the provision of Partnership Deed (or as per the provision of Indian Partnership Act, 1932 in the absence of Partnership Deed) It is an extension of profit and Loss Account It is nominal account It records entries for interest on capital, Interest on Drawings, Salary to the partner

A B And C Are Partners In A Firm Partnership Deed Does Not Provides For Interest On Capital Still It Was Caredited To Partners Capital Accounts 5 P A For The Two

Ts Grewal Solutions Archives Page 3 Of 5 Ncert Books

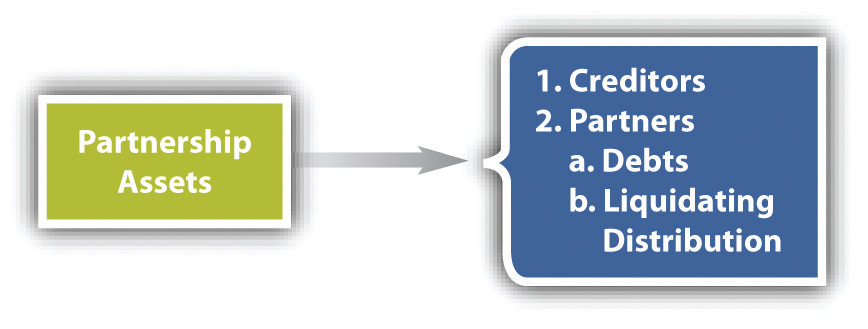

Of the partners In the absence of partnership deed, there may arise a controversy on certain issues like profit sharing ratio, interest on capital, interest on drawings, interest on loan and salary of the partners In such cases, the provisions of the Indian Partnership Act becomes applicable Some of the Issues are (i) Distribution of Profit Partners are entitled to share profits equallyProvisions Applicable in the Absence of Partnership Agreement/Partnership Deed 1 Interest is not allowed on Partners' Capitals or charged on Drawings 2 Partner is not entitled to salary or remuneration for the work done for the firm 3 Interest @ 6% pa is allowed on the loans advanced by any partner 4 Profit or loss is distributedIn the absence of partnership deed partners are entitled to what percent of profit as salary makwanaroshni3 makwanaroshni3 Accountancy Secondary School answered In the absence of partnership deed partners are entitled to what percent of profit as salary 1 See answer Advertisement Advertisement makwanaroshni3 is waiting for your help Add your

Section 40 B Deduction For Salary And Interest Partnership Business

Nature Of Partnership And Partnership Deed Concepts With Examples

In the absence of a specific provision in the partnership deed, a partner making, for the purposes of the business, any payment or advance beyond the amount of capital he has agreed to subscribe, is entitled to interest thereon at the rate of six per cent per annum View Full Answer Its FREE, you're just one step away Single Correct Medium Published on 18th 09, Next Question In the absence of partnership deed, the following rule will apply (A) No interest on capital (B) Profit sharing in capital ratio Profit based salary to working partner (D) 9% pa interest on drawings 24 In the absence of agreement, partners are not entitled to (A) Salary (B) Commission Equal share in profit (D) Both (a) and (b) 25 Interest on capital will be paid to the partnersSalary to Partner – Not entitled;

Addition And Removal Of Partners Partnership Act Indiafilings

Rights Of Partner As Per The Indian Partnership Act 1932

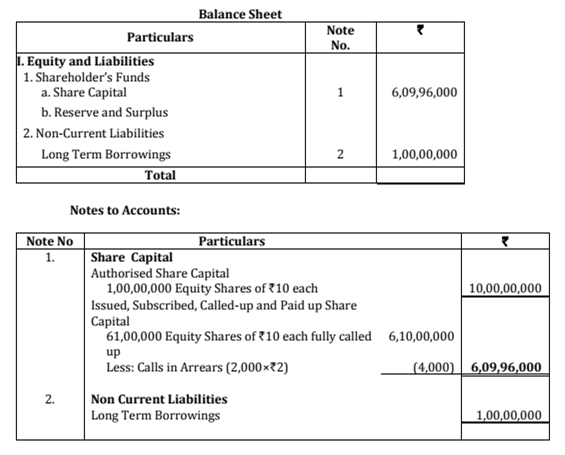

Interest on Drawings – Not Charged;Even accounting for partnership firms is a function that is to be carried on in accordance with the provisions in the "Partnership Deed" Salary to be paid to partners, profits to be shared among partners, interest on capital, interest on drawings, etc, are all to be decided based on the agreement between the partners (ie based on the partnership deed) Thus in accounting for In the absence of an agreement, partners are entitled to (a) Salary (b) Profit share in capital ratio (c) Interest on loan and advances (d) Commission Answer Answer (c) Interest on loan and advances

2nd Puc Accountancy Question Bank Chapter 2 Accounting For Not For Profit Organisation Kseeb Solutions

Q 1 What Are Provision Relating To Governance Of Right To Share

Interest on Loan – 6% pa Admission of partner – Consent of all partners;Partners can make or insert clauses in their partnership deed In case if partner does not make agreement or deed, then partners are entitled for interest on loans and advances and their profit sharing ratio will be equal They are not entitled for salaryIn the absence of an agreement, the partners are not entitled to (A) Salary (B) Commission Same share in profit (D) a) and b) 50 In a lirm partnership, partner A is entitled to a monthly salary of 7,500 USEuro At the end of the year, the company earned a profit of 75,000 euros us after demanding T`s salary in The Mouth Ehin

2

Accounting For Partnerships Ppt Video Online Download

Sep 29,21 In the absence of an agreement, partners are entitled toa)Salaryb)commissionc)Interest on loans and advancesd)Profit share in capital ratioCorrect answer is option 'C' Can you explain this answer?According to Partnership Act 1932, in the absence of any agreement between partners , profit and loss must be shared equally , regardless of the ratio of the partners investments Otherwise there will be disagreements and quarrels among the partnersIn the absence of Partnership Deed, the profits of a firm are divided among the partners (a) In the ratio of Capital (b) Equally (c) In the ratio of time devoted for the firm's business (d) According to the managerial abilities of the partners Answer (b) Equally Question Mr Ram and Sons maintains the Capital Accounts under which it prepares Partners' Capital Account as well as

Partnership Deed Q 1 Q 6 Ch 2 Ts Grewal S 21 Class 12th

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Fundamentals Ncert Books

PROFIT SHARING RATIO The partners must decide their mutual profit sharing ratio In the absence of this, the partners will distribute the profits/losses in equal ratio PARTNER'S DRAWINGS The right of partners to make withdrawal from the business must be mentioned in the partnership deed along with the limit of the withdrawal INTEREST ON DRAWINGS Partnership deedPartnership deed also defines a remuneration or salary of the partners and working partners However, interest is paid to each partner who has invested capital in the business Also Check The importance of the Partnership Agreement The above mentioned concept about Partnership Deed is explained in detail for Class 12 students To know moreAbsence of DeedWhen there is no partnership deed among partners then we will do the followingProfit Sharing Ratio – Equally;

Max Salary Remuneration In Case Of Partnership Chapter 7 Business In

1

The partnership deed provided that Janat is to be paid a salary of Rs 3,000 per month and Batool a commission of % on net profit It is also provided that interest on capital is allowed at 8 percent per annum and interest on drawing at 6% per annum The drawings were Janat Rs 10,000 and Batool Rs 15,000 The net amount of profit as per profit and loss accountHow do you Treat in the absence of partnership Deedsharing profit, interest on drawing, capital, salary to partnerand loan from partner in explanation in Antony and Ranjith Started a business on 1st April 18 with capitals of ₹ 4,00,000 and ₹ 3,00,000 respect According to the Partnership Deed, Anton is to get the salary of ₹ 90,000 per annum, Ranj ith is got 25% commission on profit after allowing salary to Antony and interest on capital @ 5% pa but before charging such commission The profitsharing ratio between the two partners

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 19

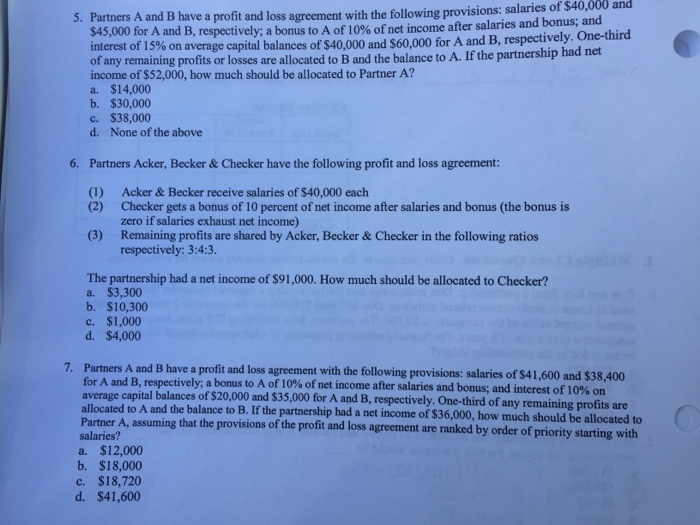

Distribution Of Profit In A Partnership Explanation Examples Finance Strategists

Can partners sharing profit and losses in their capital ratio in the absence of partnership deed?(iv) Interest on Partners Loan In the absence of partnership deed if partner gives any loan to the firm he/she will be entitled to get a fixed percentage of interest @6% of annum (v) Salary of Partner In the absence of the partnership deed a partner will be entitled for getting any salary for his work even if the others are non working Hence if a firm is not having any written agreement or a partnership deed or if partnership deed is there but it is silent on certain issues the following provisions of the Indian Partnership Act 1932 will be applicable 1 Profit sharing Ratio Profits and losses would be shared equally among partners 2 Interest on capital No interest on

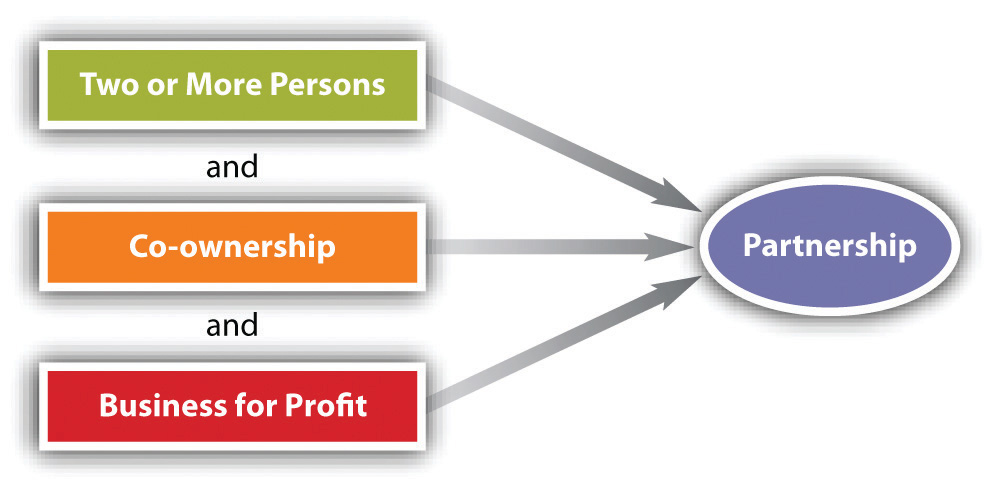

Partnerships General Characteristics And Formation

Partnership Agreement What It Is Nerdwallet

Answer In case of partnership deed is silent then section 2 of the Partnership Act 1932 will apply according to the Section partners are not provided with remuneration it is clearly mentioned that unless there is an agreement between the partners to the contradiction of section the partnersEduRev CA Foundation Question is disucussed on EduRev Study Group by 2 CA Foundation Students (i) Sharing of profits and losses If the partnership deed is silent on sharing of profit or losses among the partners of a firm, then according to the Partnership Act of 1932, profits and losses are to be shared equally by all the partners of the firm (ii) Interest on partner's capital If the partnership deed is silent on interest on partner's capital, then according to the Partnership

All You Need To Know About The Indian Partnership Act 1932

2

In the absence of a Partnership Deed, or if the Partnership Deed is silent on a certain point, the following provisions of partnership Act, 1932 will be applicable Profit and losses are to be shared equally irrespective of their capital contribution No interest on capital shall be allowed to the partners No interest on drawing will be charged No partner is entitled to get the salaryIn the absence of partnership deed, on 31st March 19 he will receive interest ₹3,000 Zero ₹2,500 ₹1,800 7 X, Y, and Z are partners in a firm At the time of division of profit for the year, there was dispute between the partners Profit before interest on partner's capital was ₹6,000 and Y determined interest @24% pa on his loan of ₹80,000 There was no agreement on this

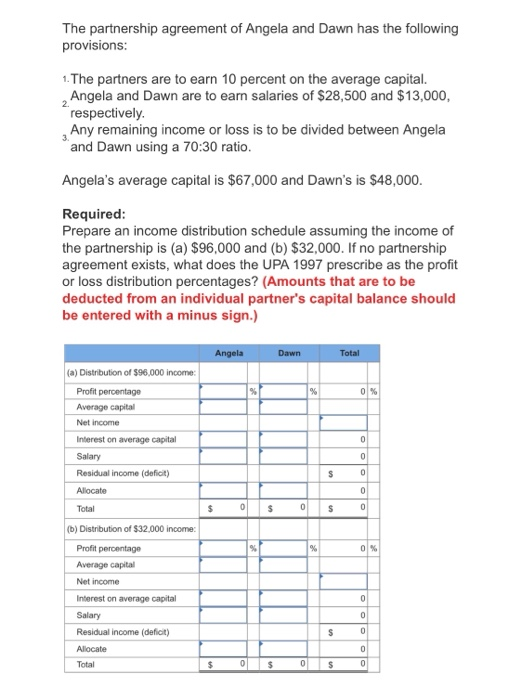

Solved The Partnership Agreement Of Angela And Dawn Has The Chegg Com

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 19

Samacheer Kalvi 12th Accountancy Guide Chapter 3 Accounts Of Partnership Firms Fundamentals Samacheer Kalvi

Accounting For Partnership Basic Concepts Popular Questions Icse Class 12 Commerce Accountancy Partnership Accounts Meritnation

Ravi And Tiku Are Partners In A Firm According To Their Partnership Deed I Interest On Capital Will Be Allowed 5 Per Annum Sarthaks Econnect Largest Online Education Community

Ts Grewal Solutions Archives Page 3 Of 5 Ncert Books

2

2 Accountancy Chapter 2 Accounting For Partnership Basic Concepts

Solved Partners A And B Have A Profit And Loss Agreement Chegg Com

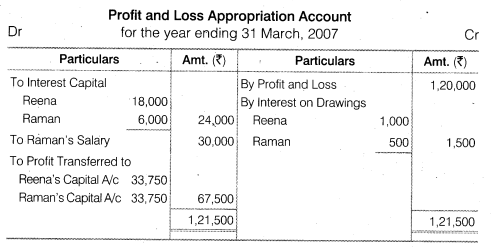

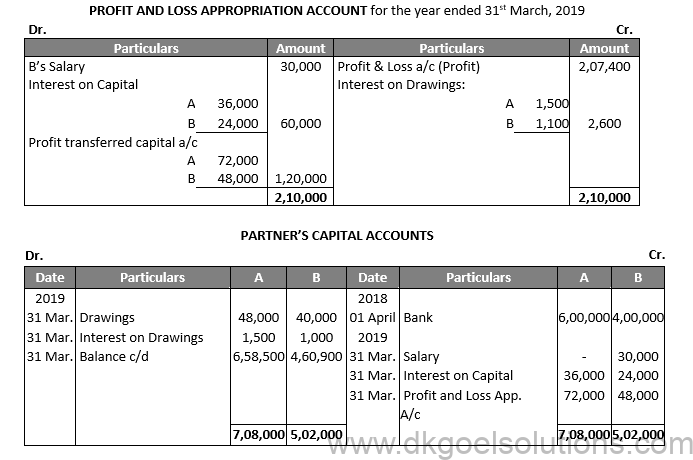

Profit And Loss Appropriation Account Accountancy Knowledge

Rights And Responsibilities Of Partners In A Partnership Firm Legalwiz In

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 19

Interest Remuneration To Partners Section 40 B

Amit A Partner In A Partnership Firm Withdrew 7 000 In The Beginning Of Each Quarter For How Many Months Would Interest On Drawings Be Charged

Dk Goel Solutions Class 12 Chapter 2 Free Study Material

X And Y Entered Into Partnership On 1st April 17 And Contributed Rs 2 00 000 And Rs 1 50 000 Respectively Sarthaks Econnect Largest Online Education Community

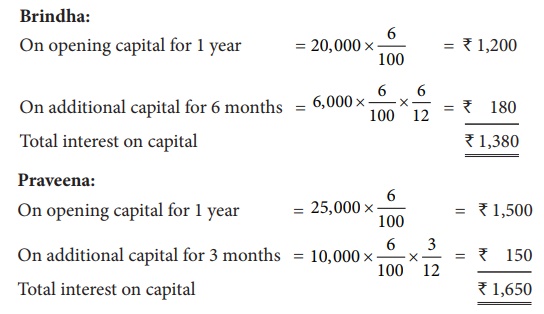

Calculation Of Interest On Capital Accounts Of Partnership Firms Fundamentals Accountancy

Important Questions For Cbse Class 12 Accountancy Death Of A Partner

1

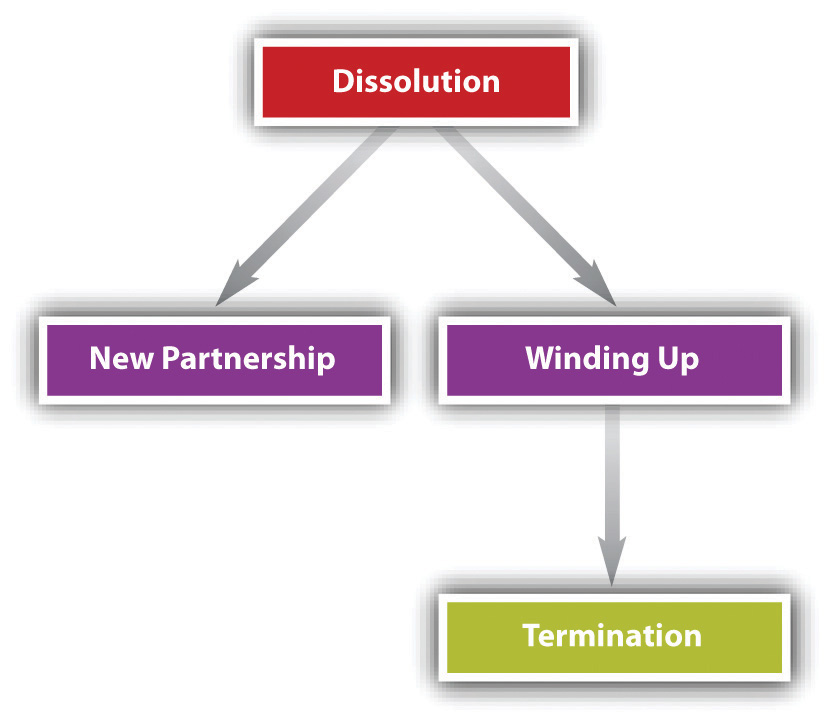

All About Dissolution And Reconstitution Tax On Partnership Firm

Rights Of Partner As Per The Indian Partnership Act 1932

1

Profit And Loss Appropriation Account Problems And Solutions

Partnership Accounts

Free Partnership Agreement Create Download And Print Lawdepot Us

X And Y Are Partners In A Firm X Is Entitled To A Salary Of Rs 10 000 Per Month And Commission Of 10 Sarthaks Econnect Largest Online Education Community

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts

/GettyImages-1152013583-a5bad8090c064339bf7880b7c9012379.jpg)

Which Terms Should Be Included In A Partnership Agreement

P And Q Were Partners In A Firm Sharing Profits And Losses Equally Their Fixed Capitals Were 2 00 000 And 3 00 000 Respectively The Partnership Deed Provided For Interest On Capital

2

Partnership Definition Features Advantages Limitations

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 21

Profit And Loss Appropriation Account Accountancy Knowledge

Accounting For Partnership Notes Class 12 Accountancy

Asif And Ravi Are Partners In A Firm Sharing Profits And Losses In The Ratio Of 3 2 Their Fixed Capitals As On 1 St April 16 Were Rs 6 00 000 And Rs

How To Create A Business Partnership Agreement Free Template

Accounting For Partnership Notes Class 12 Accountancy

2

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 19

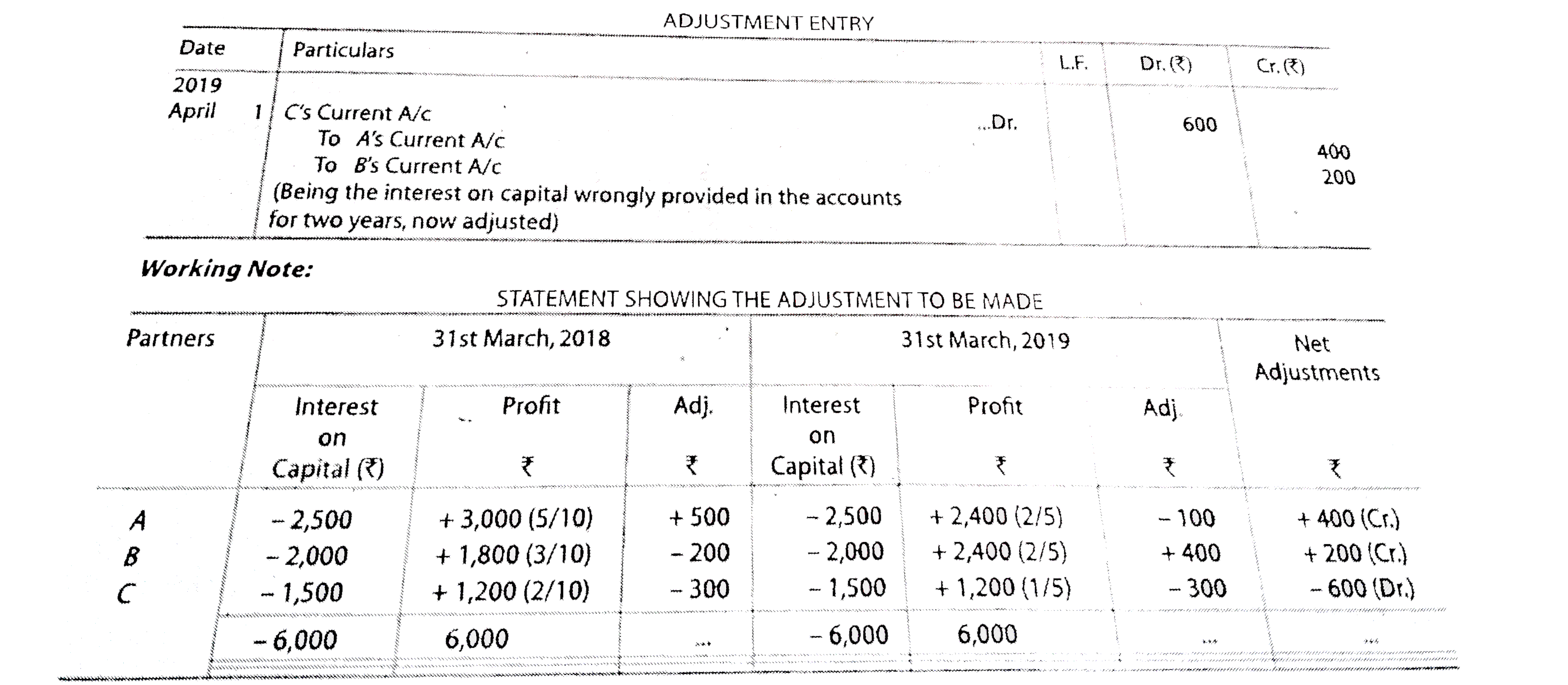

Important Questions For Cbse Class 12 Accountancy Past Adjustments And Guarantee Of Profits To A Partner

Rights And Duties Of Partners In Partnership Online Indiafilings

Ts Grewal Solution Class 12 Chapter 2 Accounting For Partnership Firms Fundamentals 21

Reema And Seema Are Partners Sharing Profits Equally The Partnership Deed Provides That Both Sarthaks Econnect Largest Online Education Community

Ans D Capital A C Dr 0 C Capital A C Dr 100 And A Capital A C 300 42 Krishna Arjun And Bhim Are Partners In A Firm The Balance Of Their

Q 1 What Are Provision Relating To Governance Of Right To Share

Partnership Rules Faqs Findlaw

Dk Goel Solutions Class 12 Chapter 2 Free Study Material

Relation Of Partners Inter Se Rights And Duties Ipleaders

Accounting For Partnership Notes Class 12 Accountancy

Remuneration To Partners In Partnership Firm Under 40 B

Topic 8 Partnership Part I

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts

Page 53 Debk Vol 1

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Fundamentals Ncert Books

Solved The Partnership Agreement Of A B And C Stipulates The Following Partners A And C Shall Receive Annual Salaries Of 12 000 And 8 000 Respec Course Hero

Topic 8 Partnership Part I

1

Partnership Operation And Termination

Important Questions For Cbse Class 12 Accountancy Past Adjustments And Guarantee Of Profits To A Partner

Pb H8htvwdu7m

Samacheer Kalvi 12th Accountancy Guide Chapter 3 Accounts Of Partnership Firms Fundamentals Samacheer Kalvi

Samacheer Kalvi 12th Accountancy Guide Chapter 3 Accounts Of Partnership Firms Fundamentals Samacheer Kalvi

Partnership Operation And Termination

2

2

Accounting For Partnership Notes Class 12 Accountancy

X And Y Are Partners In A Firm X Is Entitled To A Salary Of Rs 10 000 Per Month And Commission Of 10 Sarthaks Econnect Largest Online Education Community

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Fundamentals Ncert Books

Partnership Definition Features Advantages Limitations

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts

Partnership Accounts

Partnership Deed Q 1 Q 6 Ch 2 Ts Grewal S 21 Class 12th

Samacheer Kalvi 12th Accountancy Guide Chapter 3 Accounts Of Partnership Firms Fundamentals Samacheer Kalvi

Accounting For Partnership Notes Class 12 Accountancy

2

Ts Grewal Solutions For Class 12 Accountancy Accounting For Partnership Firms Fundamentals Cbse Tuts

コメント

コメントを投稿