[最も欲しかった] in absence of partnership deed 694760-In absence of partnership deed interest on loan of a partner is allowed

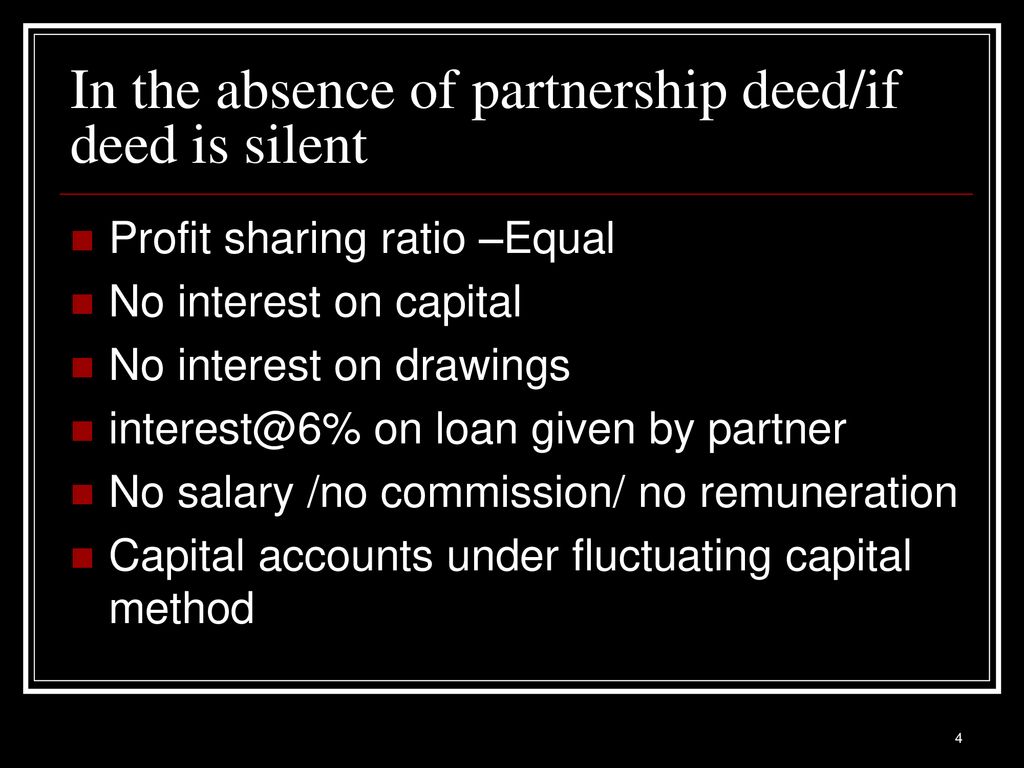

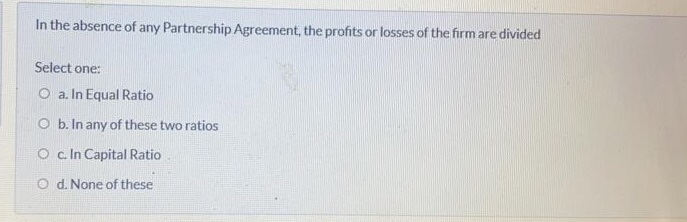

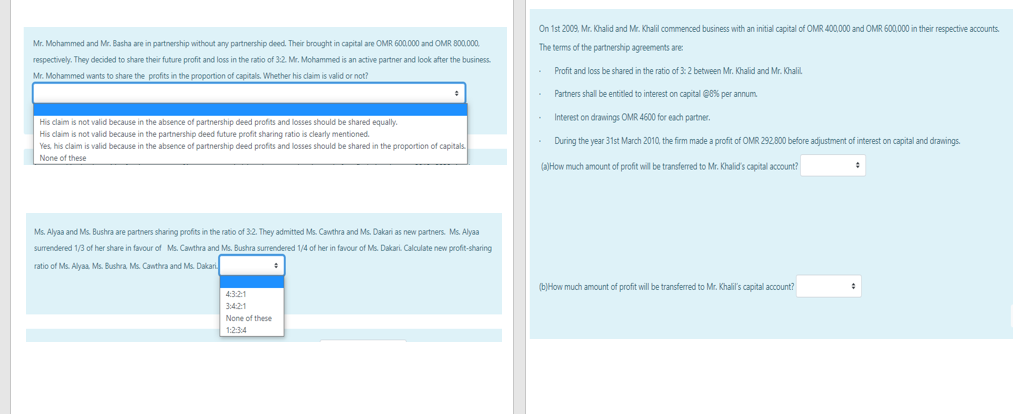

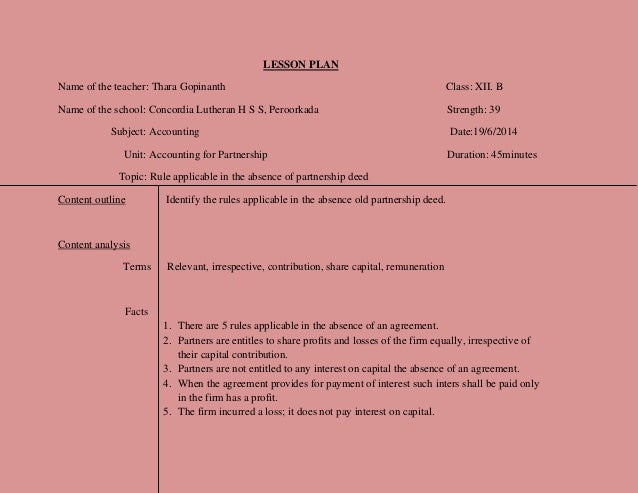

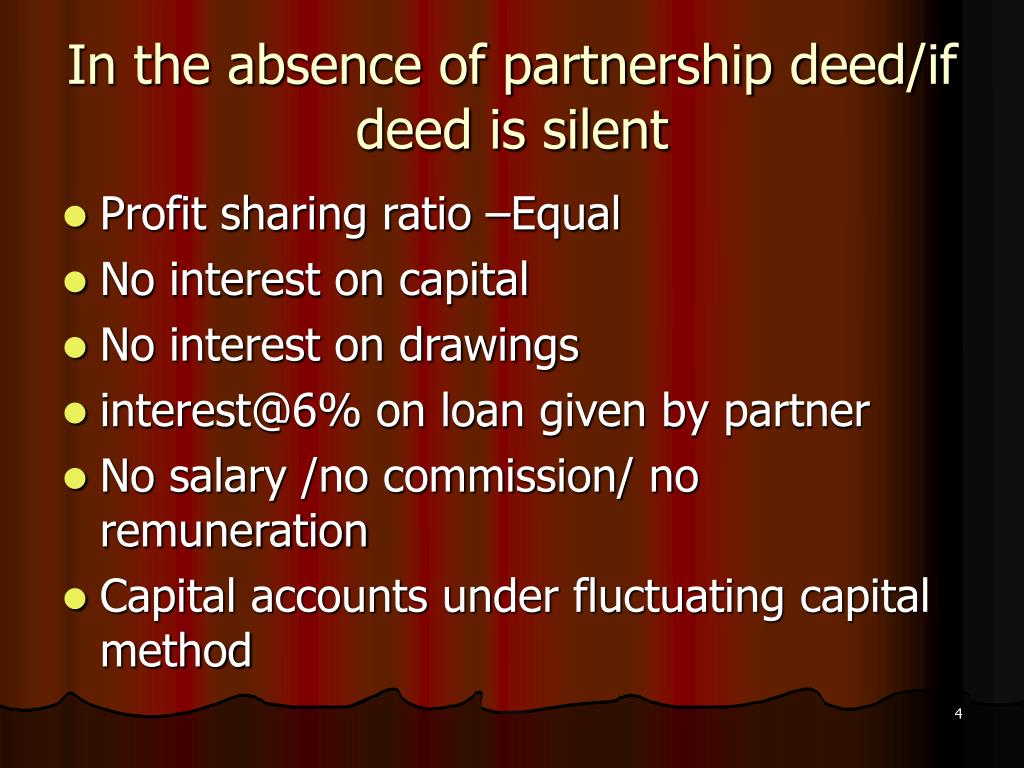

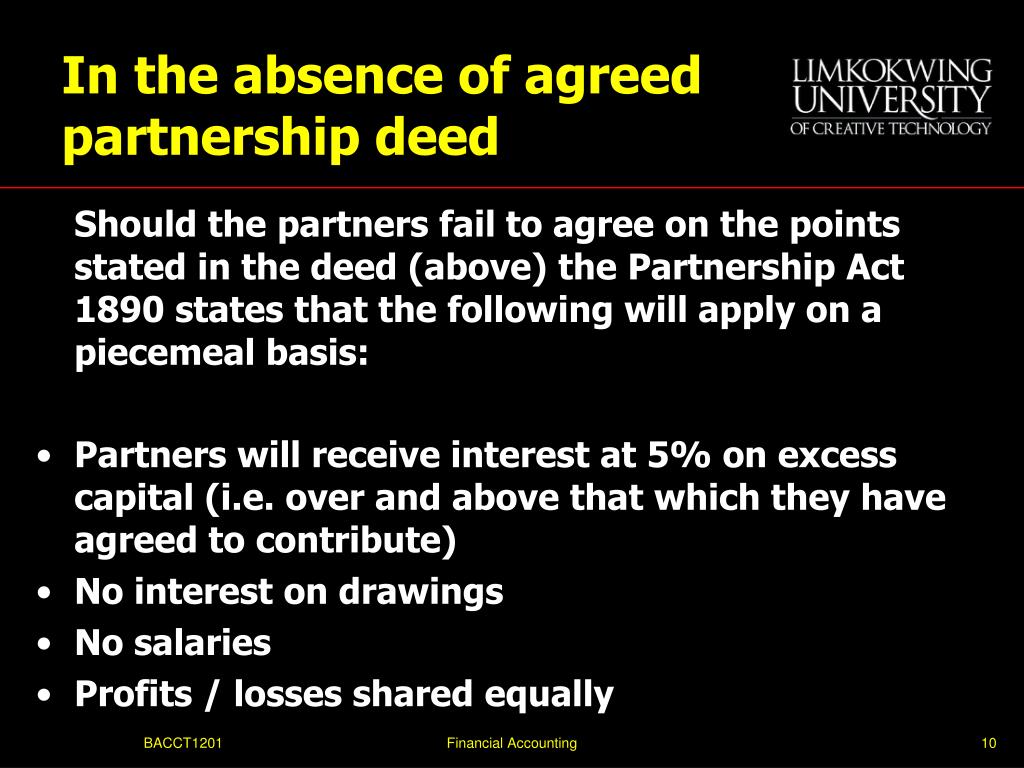

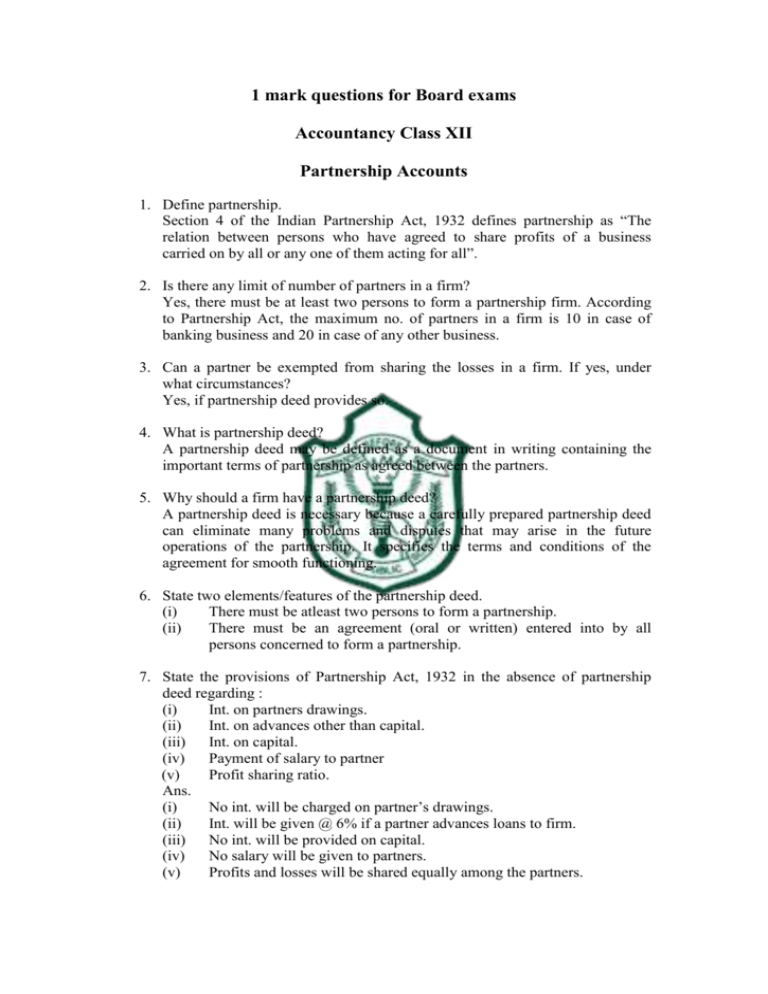

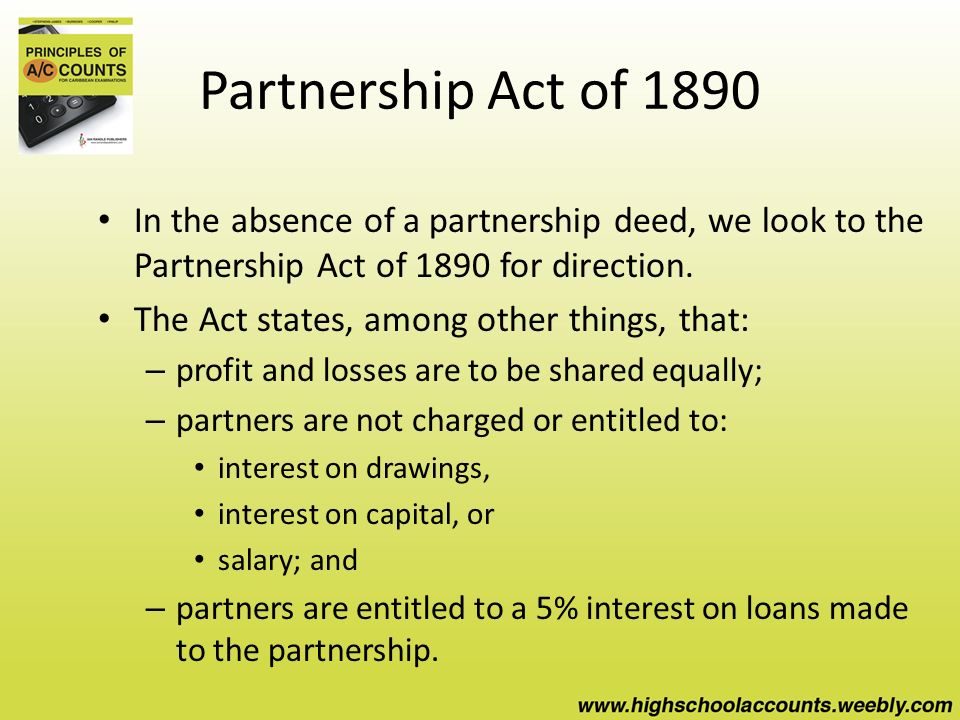

In the absence of a partnership deed, the provisions of the Indian Partnership Act, 1932, apply According to the Act, asked in Accounts by Sakil Alam ( 641k points)Option D – Interest should not be allowed on partners drawings Explanation Under the Partnership Act, the following rules will be applied in the absence of an agreement among partners i Profit or losses of the firm will be shared equally by the partners ii Interest on capital will not be allowed to any partner iiiQ1 In the absence of partnership deed how much interest will be given on capital?

Magonlinelibrary Com

In absence of partnership deed interest on loan of a partner is allowed

In absence of partnership deed interest on loan of a partner is allowed- A and B were sharing profits of a business in the ratio of 3 2 They admit C into partnership, who gets 1/3 of A's share of profit from A, 1/2 of B's share of profit from B The new profit sharing ratio will be– 8 In the absence of a Partnership Deed, the rate of interest allowed on the partner's loan to the firm is– 9In the absence of partnership deed,how are the following matters resolved (a)Salaries of partners (b)Interest Ask questions, doubts, problems and we will help you

Create An Amendment To A Partnership Agreement Legal Templates

In the absence of partnership deed mutual relations are governed by the Indian partnership act 13 Answer True Question When new partner share of profit is more than the guaranteed profit then he is given only the guaranteed amount of profit Answer False QuestionPartners share profit and losses in _____ ratio in the absence of partnership deed Book Keeping and Accountancy Advertisement Remove all ads Advertisement Remove all ads Advertisement Remove all ads Fill in the BlanksEduRev Commerce Question is disucussed on EduRev Study Group by 1237 Commerce Students

In the absence of Partnership Deed, interest on loan of a partner is allowed (a) at 8% per annum (b) at 6% per annum (c) no interest is allowed (d) at 12% per annum Answer b) 6% per annum One Word / Sentence line Answers Question In the absence of Partnership deed, profit and loss among partners will be shared(i) 5% pa (ii) 6% pa (iii) 7% pa (iv) No interest Show AnswerApplication of the provisions of the Indian Partnership Act, 1932 in the absence of partnership deed If there is no partnership deed or when there is no express statement in the partnership deed, then the following provisions of the Act will apply (i) Remuneration to partners No salary or remuneration is allowed to any partner Section 13(a)

In the absence of partnership deed, the partner will be allowed interest on the amount advanced to the firm by him at the rate of (A) 6% (B) 6% pa 12% In the absence of partnership deed or verbal agreement, or if the partnership deed is silent on a certain point, the following provisions of the Indian Partnership Act, 1932 will be applicable PROFIT SHARING RATIO Profits and losses are to be shared equally irrespective of their capital contribution The partnership deed provided that interest on capital shall be allowed at 9% per annum During the year the firm earned a profit of Rs 7,800 Showing your calculations clearly, prepare 'Profit and Loss Appropriation Account' of Jay and Vijay for the year ended

In The Absence Of Any Agreement The Partners Are Entitled To Share Profits

Accounting For Partnership Firms Fundamentals Part 1 Notes Edurev

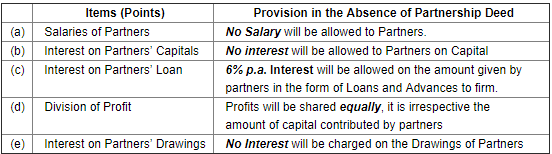

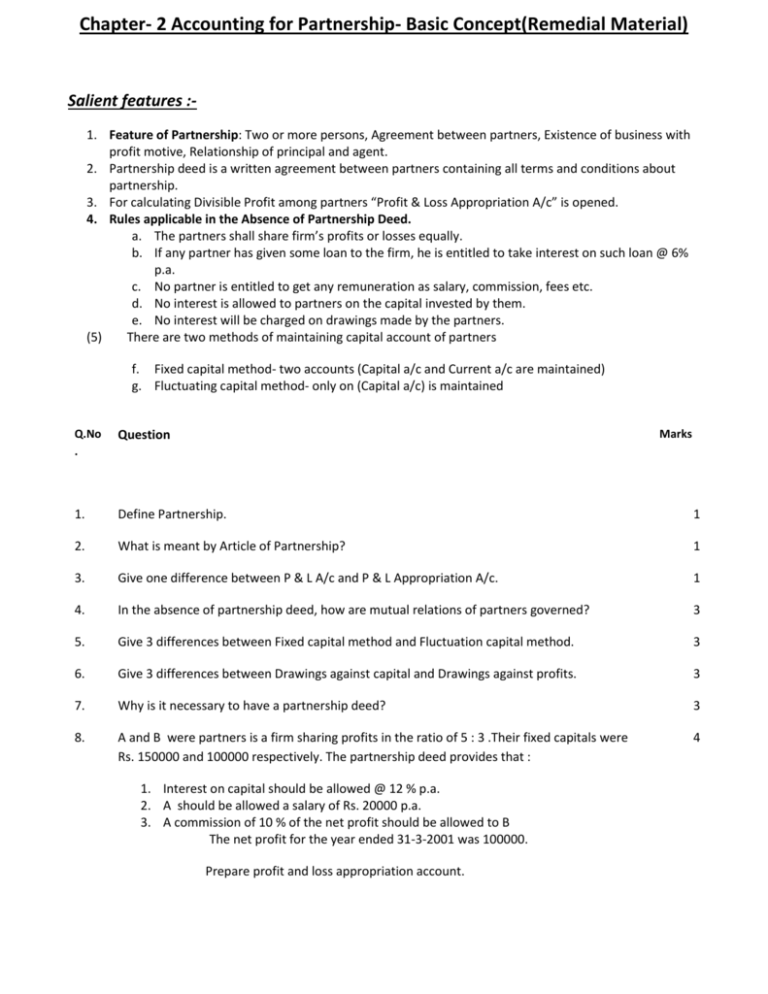

The document which contains terms and conditions of partnership is known as Partnership Deed In the absence of an agreement, the partnership Act is applied, However, the act leaves it to the discretion of partners The written agreement between partners will be helpful in case of disputes between the partners Important Points of a Partnership DeedIn the absence of partnership deed, profits and losses will be distributed equally among the partners Answers 10 – a) Equal Fundamentals of Partnership class 12 MCQ – Explanation 11In the absence of partnership deed, no interest in allowed on capital and no interest is provision in the absence of partnership deed (a) salaries to partners No salary will be allowed to partners (b) Interest on partners No interest will be allowed to partners on their capital (c) Interest on partner loan 6% pa interest will be allowed on the money given by parters to the firm in the form of loans and advances (d

Rules Applicable In The Absence Of Partnership Deed Youtube

P 1 Ppt Powerpoint

In the absence of a partnership deed, the following rules have to be followed 1 The partners are entitled to share the profits or losses equally 2 Partners are not entitled to interest on their capital 3 No partner will be allowed salary, or any other remuneration for any extra work done for the firmInterest will be charged @ 5% pa on partner's drawings Interest will be charged @ 6% pa on partner's drawings Interest will be charged @ 12% pa on partner's drawings 6 In the absence of a partnership deed, the allowable rate of interest onAnswer In case of partnership deed is silent then section 2 of the Partnership Act 1932 will apply according to the Section partners are not provided with remuneration it is clearly mentioned that unless there is an agreement between the partners to

Cbse Class 12 Profit And Loss Appropriation Account Part 1 Offered By Unacademy

Partnership Deed Meaning Format Registration Stamp Duty

In the absence of partnership deed partners are entitled to >> In the absence of partnershProvisions of the Partnership Act In the event of absence of a partnership agreement/deed or in the event of ambiguity therein, the provisions to the partnership Act will apply The provisions state that, unless the partnership deed indicates otherwise, Every partner has a right to take part in the conduct of business; partnership deed Ans – a) In the absence of Partnership Deed, the interest is allowed on partner's capital a) @ 5% pa b) @ 6% pa c) @ 12% pa d) No interest is allowed Ans – d) In the absence of a partnership deee, the allowable rate of interest on partners loan account will be a) 6% Simple Interest b) 6% pa Simple Interst c) 12% Simple Interest d) 12% Compunded

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Zoefact

Question 1 Not Yet Answered Marked Out Of 1 P Flag Chegg Com

In absence of partnership deed, the deficiency arising out of guarantee of it will be borne by the other partners in the Profit sharing ratio and in absence of other partners it will be borne by the remaining partner in its entirety ie fully Sep 29,21 In the absence of partnership deed, the profit will be divided among partners a In the capital ratio b In equal ratio c In any ratio d Not in any ratio?In partnership business written Agreement is most important for future by this we Can solve any types disputesBut if partners do not prepare Partnership dea

Gv Commerce Classes Posts Facebook

Partnership Deed Its Importance And Rights Of Partners Accounting Finance

Oct 11,21 In the absence of any deed of partnershipa)Only working partners are entitled to Salaryb)Partners are entitled for commission @ 6% of the net profits of the firmc)Partners contributing highest capital is entitled for interest on capital @ 6% pad)Interest at the rate of 6% is to be allowed on a partner's loan to the firmCorrect answer is option 'D' The partnership deed determines the general administration of the partnership like what will be the profitsharing ratio, who will do what work etc The partnership contains the rights and duties of the partners Such a deed can be made either expressly or by necessary implication Definition Partnership is a type of business in which two or more individuals combines their hands to perform an activity and distribute its profits and lossesIt constitutes an agreement known as a partnership deed The Indian Partnership Act,1932 regulate evolution and administration of partnership firms

Accounting For Partnership

Indian Partnership Act

In the absence of partnership deed, profit will be distributed equally between all partners Answer Answer True Rules applicable in the absence of Partnership Deed Sharing of Profits – In the absence of any partnership deed, the profits among the partners should be shared equally Salary/commission to the partners The partners won't get any portion of profit as salary/commission for their active participation in the businessHow do you Treat in the absence of partnership Deedsharing profit, interest on drawing, capital, salary to partnerand loan from partner in explanation in

Create An Amendment To A Partnership Agreement Legal Templates

Welcome Chapter1 Accounting For Partnership Basic Concepts Introduction

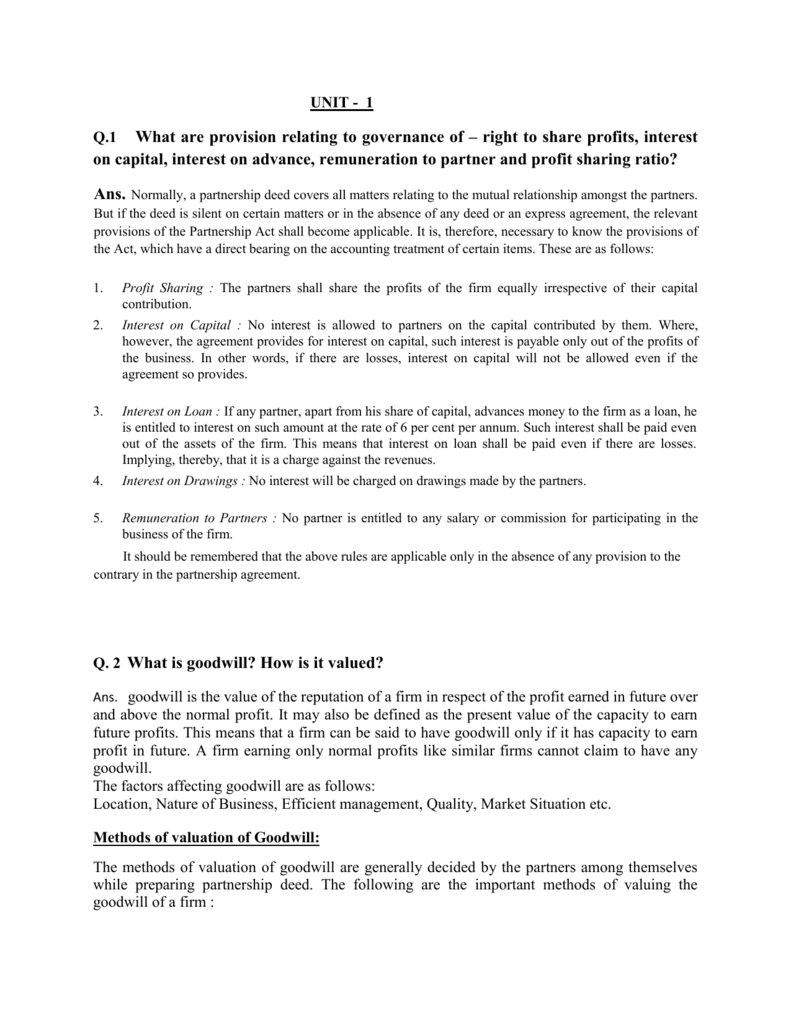

Short Note In the absence of partnership deed, specify the rules relating to the following (i) Sharing of profits and losses (ii) Interest on partner's capital (iii) Interest on Partner's drawings (iv) Interest on Partner's loan (v) Salary to a partner Advertisement Remove all ads A partnership deed is mostly said to be a contract that is made between the partners of the business This binds each of the partners in a legal relationship The minimum requirement for forming a partnership is that there are at least two members and with no more than 10 members in the case of banking and in the case of nonbanking businessesOn 1st June, 18 a partner introduced in the firm additional capital Rs 50,000 In the absence of partnership deed, on 31st March, 19 he will receive interest A

Discuss The Main Provisions Of Indian Partnership Act 1932 That Are Relevant To Partnership Account If There Is No Partnership Accountancy Accounting For Partnership Basic Concepts Meritnation Com

Ailmigojsoruom

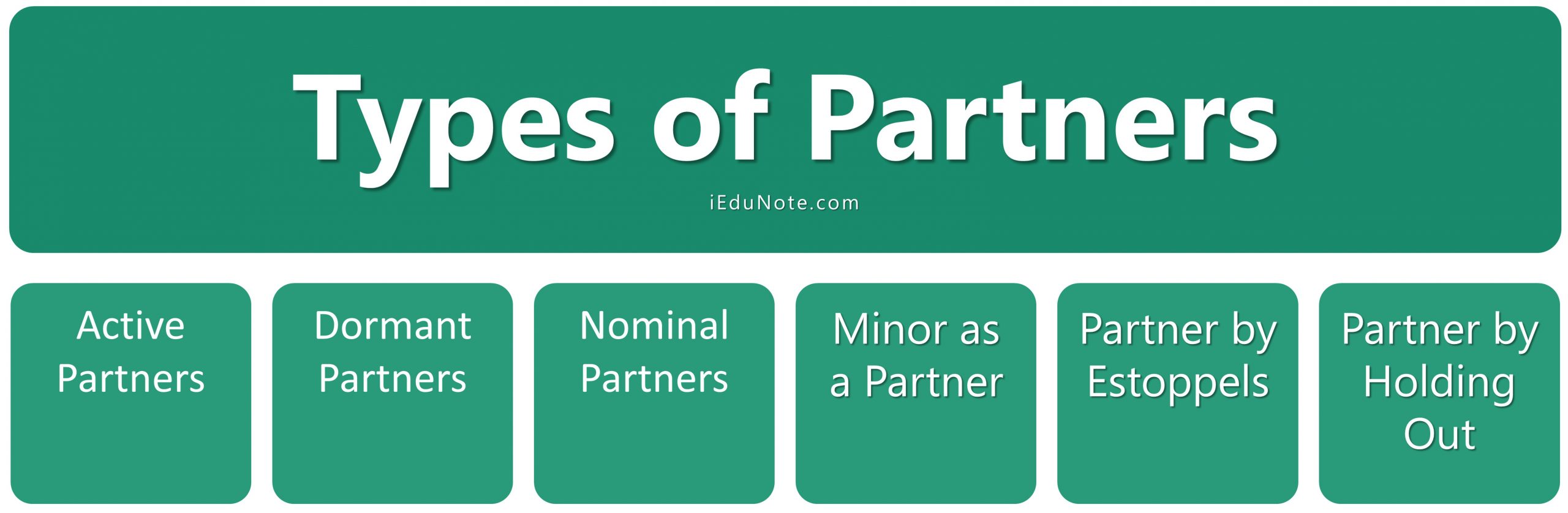

Partnership deed is a partnership agreement between the partners of the firm which outlines the terms and conditions of the partnership between the partners The purpose of a partnership deed is to provide clear understanding of the roles of each partner, which ensures smooth running of the operations of the firm(iv) Interest on Partners Loan In the absence of partnership deed if partner gives any loan to the firm he/she will be entitled to get a fixed percentage of interest @6% of annum (v) Salary of Partner In the absence of the partnership deed a partner will be entitled for getting any salary for his work even if the others are non working In absence of Partnership agreement interest on partner's loan/Advance will be calculated at 6% pa (5% / 6% / 8%) 14 The partner who does not participate actively in partnership business is knows as nominal (nominal / inactive) partner

Accountant Images Nainagsingh Sharechat भ रत क अपन भ रत य स शल न टवर क 100 भ रत य एप प

Partnership Deed Meaning Format Registration Stamp Duty

The Partnership Deed is a legal document addresses the rights and obligations of the parties to the partnership This is like a constitution which shows the direction on how the partners under the partnership should regulate themselves On other way we can say this document is the contract whereby the partners are bound to follow In the absence of a partnership deed, the allowable rate of interest on partner's loan account will be (A) 6% Simple Interest (B) 6% pa Simple Interest 12% Simple Interest (D) 12% Compounded Annually Answer Answer B A and B are partners inPartnership is an agreement between persons to carry on a business The agreement entered into between partners may be either oral or written But, it is always desirable to have a written agreement so as to avoid misunderstandings and unnecessary litigations in future When the agreement is in written form, it is called 'Partnership Deed'

5

In The Absence Of Partnership Deed How Are The Following Matters Resolved 1 Interest On Loan By Partner S And Accountancy Accounting For Partnership Basic Concepts Meritnation Com

In the absence of Partnership Deed AInterest will not be charged on partner's drawings,BInterest will be charged @ 5% pa on partner's drawings,CInterest will be charged @ 6% pa on partner's drawings,DInterest will be charged @ 12% pa on partner's drawingsIn the absence of partnership deed, profits of a firm are distributed equally among all the partners Profit after Interest on A's loan = 15,000 − 240 = Rs 14,760 Pofit of A and B=14,760×1/2=7380 Question 6 Harshad and Dhiman are in partnership since 1st April, No partnership agreement was madeAccountancy In the absence of partnership Deed, what are the rules relating to (a) Salaries of partners, (b) Interest on partners' capitals, (c) Interest on partners loan, (d) Division of profit,

Study Materialworkshop 16 Pdf Debits And Credits Goodwill Accounting

Cbse Class 12 Rules Applicable In Absence Partnership Deed With Illustration In Hindi Offered By Unacademy

ZIn the Absence of the Partnership Deed The partnership deed lays down the terms and conditions of partnership in regard to rights, duties and obligations of the partners In the absence of partnership deed, there may arise a controversy on certain issues like profit sharing ratio, interest on capital, interest on drawings, In the absence of partnership deed if partner gives any loan to the firm he/she will be entitled to get fixed percentage of interest @6% of annum (v) Salary of Partner In the absence of the patnership deed a partner will be entitled for gettingIv In case of any dispute among partners, partnership deed is considered as the basis for settlement of such dispute v Not essential but desirable to have a Partnership Deed vi Where there is no partnership deed, provisions of Indian Partnership Act, 192 will be applied Provisions Affecting Accounting Treatment in the Absence of

Cbse Class 12 Partnership Deed Concept Contents And Rules Offered By Unacademy

Accounting Finance For Bankers Jaiib Module D Ppt Download

Unit 1 Accounting For Partnership Firms Marks 35 Dissolution Of A Partnership Firm Types Of Dissolution Pdf Document

Solved Chapter 16 Problem 12p Solution Advanced Accounting 12th Edition Chegg Com

Partnership Deed Commerceiets

In The Absence Of Partnership Deed Youtube

State The Provisions Of Partnership Act 1932 In Absence Of Partnership Deed Regarding 1 Interest On Partners Drawings And 2 Interest On Accountancy Accounting For Partnership Basic Concepts Meritnation Com

In The Absence Of Any Partnership Agreement The Chegg Com

Partnership Deeds Meaning Contents With Solved Questions

On 1st 09 Mr Khalid And Mr Khalil Commenced Chegg Com

Basic Concept Sole Proprietorship Business Forms Of Business Partnership Joint Hindu Family Business Cooperative Society Company Ppt Download

Accounting Rules Applicable In The Absence Of Partnership Deed Archives Bhardwaj Accounting Academy

3

Q 1 What Are Provision Relating To Governance Of Right To Share

Class 12 Accounts Fundamental Of Accounts Notes

Accounts14

Partnership Accounting

Department Of Accounting And Finance Course Code Acc Ppt Download

1

What Is Partnership Definition Types Partnership Deed And Characteristics The Investors Book

A Partnership Deed Its Usage And Its Execution Legal News Law News Articles Free Legal Helpline Legal Tips Legal India

Support Material

Rules Applicable In The Absence Of Partnership Deed Depkblog

Rules Applicable In The Absence Of Partnership Deed Youtube

In The Absence Of Any Agreement Interest On Advances By A Partner Is

Provisions Of Partnership Deed Indian Partnership Act 1932

Basic Concept Sole Proprietorship Business Forms Of Business Partnership Joint Hindu Family Business Cooperative Society Company Ppt Download

Ts Grewal Solutions Class 12 Accountancy Accounting Partnership Firms Fundamentals 5 Accounting And Finance Accounting Fundamental

In The Absence Of Partnership Deed What Are The Rules Relation To A Salaries Of Partners B Brainly In

Partnership Deed Accounts Class 12 Arinjay Academy

Partnership Deed By Dhanya V L

Partnership Deed Q 1 Q 6 Ch 2 Ts Grewal S 21 Class 12th

Pin By Zigya On 12th Board Papers Equality Previous Year Short Answers

Mention Any Four Provisions Of The Partnership Act In The Absence Of Partnership Deed Business Studies Nature And Significance Of Management Meritnation Com

Accounting For Partnership Una Partnership Goodwill Accounting

General Reserve Is Recorded In Pand L App A C In Absence Of Partnership Deed Accountancy Accounting For Partnership Basic Concepts Meritnation Com

Partnership Deed Agreement Of Firm 15 Contents Format Types

Rules Applicable In Absence Of Partnership Deed Youtube

Cbse Class 12 Lesson 2 Applicability Of Provisions In The Absence Of Partnership Deed In Hindi Offered By Unacademy

Ts Grewal Accountancy Class 12 Solutions Chapter 1 Accounting For Partnership Firms Zoefact

No Partnership Deed Exist Absence Of Partnership Deed Partners A And B Have Contacted You To Solve Brainly In

Doc Chapter 2 Accounting For Partnership Basic Concept Remedial Material Kelvin John Ramos Academia Edu

Drama Lesson Plan

Partnership Accounts Full Notes 1 Pdf Ca Anand V Kaku 91 Accounting For Partnership Basics Concepts Provisions Affecting Accounting Course Hero

Ppt Accounting Finance For Bankers Final A Cs Of Banks Cos Jaiib Module D Presentation By Ravi Ullal 24 O4 Powerpoint Presentation Id

Rules Applicable In The Absence Of Partnership Deed Youtube

Rules Applicable In The Absence Of Partnership Deed Youtube

Absence Of Partnership Deed Profit Loss Appropriation Goodwill Ca Cpt Cs Cma Foundation Youtube

Question 02 Chapter 2 Of 2 Part 1 Usha Publication 12 Class Part 1

Cbse Class 12 Rules Applicable In Absence Partnership Deed With Illustration In Hindi Offered By Unacademy

Magonlinelibrary Com

2 Business Mathematics Part I Pages 51 100 Flip Pdf Download Fliphtml5

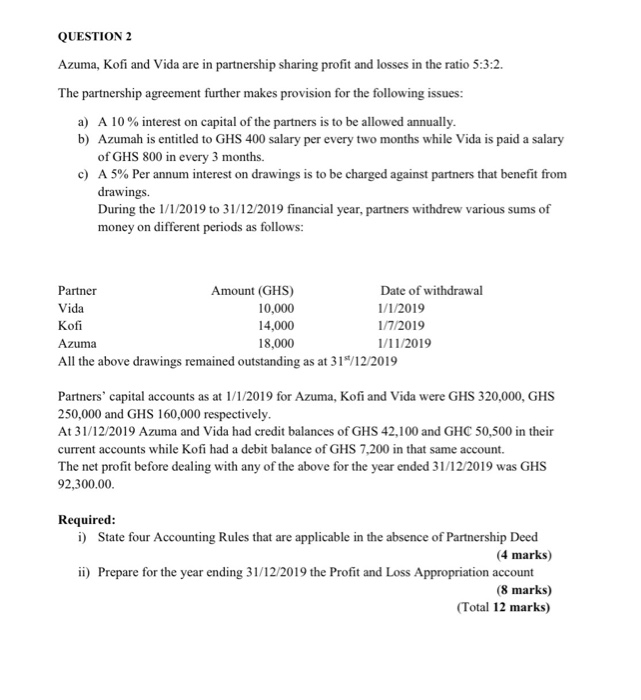

Question 2 Azuma Kofi And Vida Are In Partnership Chegg Com

Ppt Learning Objectives Powerpoint Presentation Free Download Id

/GettyImages-1152013583-a5bad8090c064339bf7880b7c9012379.jpg)

Which Terms Should Be Included In A Partnership Agreement

Class 12 Accounts Fundamental Of Accounts Notes

Partnership Accounts Full Notes 1 Pdf Ca Anand V Kaku 91 Accounting For Partnership Basics Concepts Provisions Affecting Accounting Course Hero

Nta Ugc Net Meaning And Contents Of Partnership Deed And Rules In The Absence Of Partnership Deed In Hindi Offered By Unacademy

Vsajaipur Com

Question Bank For Accountancy Class Xii 14 15

Accounting Rules Applicable In The Absence Of Partnership Deed Archives Bhardwaj Accounting Academy

Partnership Accounting Ppt Video Online Download

Profit And Losses Of The Firm Are To Be Shared Equally

Rights And Responsibilities Of Partners In A Partnership Firm Legalwiz In

Page Date 1 The Absence M Which Noctio Partners Is Divided Of Partresship Deed In Which Ratio Profit Brainly In

Nta Ugc Net Overview Of Partnership Accounts In Hindi Offered By Unacademy

Accountancy Practical Oriented Questions Section D 1 Prepare Opening Statement Of Affairs With 5 Imaginary Figures 2 Prepare Capital Accounts Of Two Partners Under Fluctuating Capital System With 5 Imaginary Figures 3

In The Name Of God

Ts Grewal Solution Class 12 Chapter 5 By Studies Today Issuu

Provisions Of Partnership Act 1932 In The Absence Of A Partnership Deed Regarding Interest On Advances Other Than Capital 10 Economics National Income Accounting Meritnation Com

Rules In The Absence Of Partnership Deed Youtube

Rules Applicable In The Absence Of Partnership Deed

Rules Applicable In The Absence Of Partnership Deed Depkblog

Types Of Partners In Partnership Business Rights Duties Liabilities Of Partners

Chapter 2 Distrubution Of Profits Pdf Partnership Interest

Gift Deed What You Must Know When Making A Gift Deed The Economic Times

What Is Partnership Deed Indian Partnership Act 1932 Ca Cpt Cs Cma Foundation Youtube

Nbsp Web Viewa And B Are Partners Sharing Profits And Losses In The Ratio Of 2 1 With Capitals Of Rs 10 00 000 And Rs 5 00 000 Respectively On 1st April 13

How Do You Treat The Following In The Absence Of Partnership Deed What Are The Provisions Of Brainly In

Page 17 Ma 12

コメント

コメントを投稿